Key Takeaways

- AI tools significantly enhance accuracy and efficiency in financial operations.

- Real-time data analysis empowers informed decision-making.

- Automation reduces human error and operational costs.

- A variety of AI-driven tools optimize different aspects of financial management.

Introduction

Effective financial management is crucial for the success of any business. With the advancement of technology, especially artificial intelligence, the landscape of financial management is rapidly transforming. AI tools for financial management are at the forefront, revolutionizing how businesses handle their finances. These tools not only automate routine tasks but also provide valuable insights for strategic planning. From the best AI accounting software to AI-powered budgeting systems, the integration of AI in financial practices is proving beneficial in numerous ways. This blog delves into the innovative role of AI tools in financial management and how they can enhance business efficiency.

Benefits of Using AI in Financial Management

Enhanced Accuracy and Efficiency

AI tools for financial management significantly enhance accuracy and efficiency in financial operations. By automating repetitive tasks, these tools reduce the chances of human error, ensuring more precise financial records. This automation allows businesses to process large volumes of data swiftly, leading to faster and more efficient financial workflows. Source

Real-Time Data Analysis and Decision-Making Support

AI-powered budgeting tools offer real-time data analysis, empowering businesses to make prompt and informed decisions. By analyzing large datasets on the fly, AI aids in quick decision-making that is critical in dynamic markets. These tools can forecast trends and provide insights that are crucial for financial planning and budgeting. Source

Reduction of Human Error and Operational Costs

AI tools for financial management reduce human errors by automating manual tasks, which also lowers operational costs. By minimizing mistakes, businesses can save significantly on financial corrections and audits. Moreover, the efficiency gained from AI automation translates into reduced labor costs and better resource allocation. Source

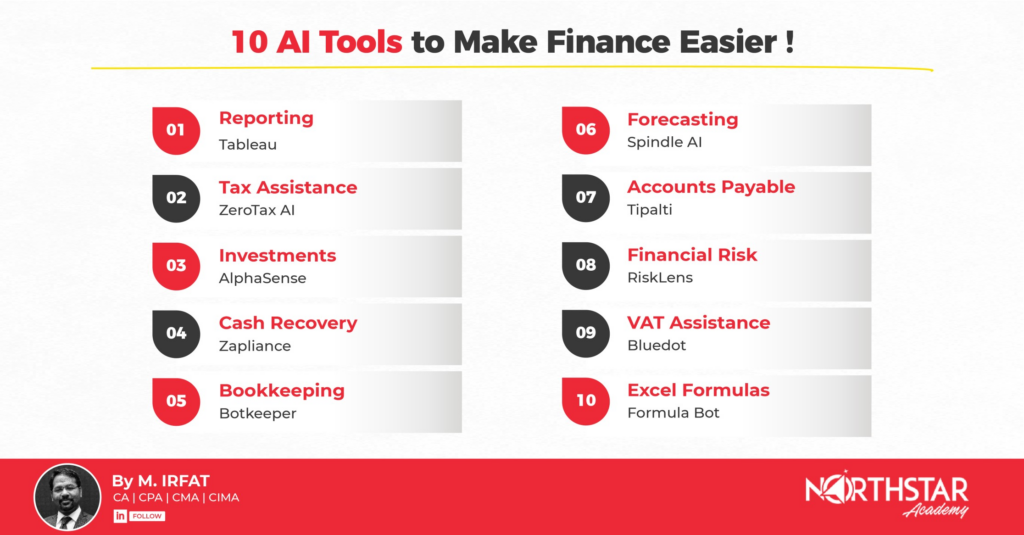

Overview of AI Tools for Financial Management

Definition and Scope

AI tools for financial management are software applications that utilize artificial intelligence to optimize and streamline financial tasks. These tools offer functionalities ranging from automated bookkeeping to advanced financial forecasting. Providing businesses with the ability to handle complex data with precision, these tools are indispensable in modern financial management. For a comprehensive understanding of AI, refer to What is AI? A Beginner’s Guide.

Types of AI-Driven Financial Tools

- AI-Powered Budgeting

- These tools use predictive analytics to dynamically create and adjust budgets.

- They take into account real-time data to provide accurate budgeting solutions.

- Learn more about everyday applications of AI in Top 10 Everyday Applications of AI You Didn’t Know About.

- Cash Flow Forecasting Tools

- These applications use historical data and machine learning to predict cash flow trends.

- They help businesses plan future financial strategies efficiently.

- AI Accounting Software

- Automates bookkeeping, invoicing, and financial reporting to enhance accuracy and save time.

- Compare different AI accounting solutions in Best AI Accounting Software.

- Fraud Detection Systems

- Utilize AI to identify and prevent fraudulent activities in financial transactions.

- Understand the mechanisms in How AI Detects Financial Fraud.

Each of these tools exemplifies the profound impact of AI in streamlining financial tasks and safeguarding financial health.

AI-Powered Budgeting

Enhancement of Budgeting Processes

AI-powered budgeting tools transform traditional budgeting methods by automating the creation and adjustment of budgets. Utilizing real-time data and predictive analytics, these systems ensure that budgets reflect the current fiscal environment and are adaptive to market changes.

Predictive Analytics and Automated Adjustments

With the assistance of machine learning models, AI-powered budgeting systems can forecast financial trends and adjust budgets autonomously. This results in more accurate and flexible financial plans compared to traditional static budgeting methods.

Advantages Over Traditional Budgeting Methods

The advantages of AI-powered budgeting include increased accuracy, adaptability, and significant time savings. With real-time adjustments, businesses can better manage their financial resources and respond swiftly to market dynamics.

How AI Helps with Cash Flow Forecasting

Role of AI in Predicting Cash Flow Trends

AI assists businesses in predicting cash flow trends by analyzing both historical data and real-time information. The insights garnered from AI forecasting tools enable businesses to plan accurately for future financial situations.

Algorithms and Data Processing

Machine learning algorithms process vast amounts of data to deliver precise cash flow predictions. These algorithms identify patterns that are not easily discernible manually, providing foresight into potential financial challenges.

Impact on Strategic Financial Planning and Liquidity Management

Accurate cash flow forecasting greatly impacts strategic financial planning and liquidity management. Businesses can maintain liquidity, optimize cash reserves, and make informed financial decisions, thereby enhancing overall financial stability.

Best AI Accounting Software

Curated List of Top AI Accounting Software

- Software X: Known for its user-friendly interface and robust financial automation capabilities.

- Software Y: Offers extensive features for large enterprises, including comprehensive reporting tools.

- Software Z: Ideal for small businesses, providing cost-effective solutions with excellent support.

Comparison of Key Features, Usability, and Pricing

Each software varies in functionalities, ease of use, and cost-effectiveness. Comparing these aspects helps businesses choose the right solution based on their specific needs and budget.

Recommendations Based on Different Business Needs and Sizes

- Startups may benefit from Software Z for its affordability.

- SMEs might find Software X suitable for its balance of features and pricing.

- Large enterprises can leverage Software Y for its advanced capabilities and scalability.

How AI Detects Financial Fraud

Mechanisms Used by AI to Identify and Prevent Fraud

AI in fraud detection monitors transactions continuously, flagging suspicious activities using advanced algorithms. These mechanisms provide a robust defense against fraudulent financial activities.

Machine Learning Models and Anomaly Detection Techniques

AI employs anomaly detection techniques and sophisticated machine learning models to spot irregular patterns. These models learn from previous data to improve the accuracy of fraud detection over time.

Importance of Fraud Detection in Safeguarding Business Finances

AI-driven fraud detection is critical for protecting businesses from financial losses. It enhances the credibility of financial systems by ensuring only legitimate transactions are processed. For insights into AI versus human intelligence, see AI vs. Human Intelligence: What’s the Difference?.

Integrating AI Tools into Your Financial Management System

Steps for Implementing AI Tools in Existing Financial Workflows

Implementing AI tools requires a strategic approach:

- Assess current financial systems and identify areas for AI integration.

- Choose the right AI tools tailored to business needs.

- Train staff and customize tools for specific business processes.

- Explore the future impact of AI on jobs in How will AI and jobs change in the future?.

Potential Challenges and Solutions

Common challenges include data compatibility and system integration issues. Solutions involve thorough planning, choosing compatible systems, and leveraging professional support for implementation.

Tips for Ensuring a Smooth Transition and Maximizing Tool Effectiveness

- Provide comprehensive training for staff.

- Customize AI tools to fit business-specific processes.

- Perform regular maintenance and updates to tools to ensure optimum performance.

Choosing the Right AI Financial Management Tool

Factors to Consider When Selecting AI Tools

- Scalability: Ensure the tool can grow with your business needs.

- Compatibility: Check if the AI tool integrates well with existing software.

- Support and Training: Evaluate the availability of customer support and training resources.

Decision-Making Framework to Align Tools with Business Objectives

Develop a framework or checklist that aligns potential tools with business values and objectives. Ensure that chosen tools not only meet current demands but also support long-term financial strategies.

Conclusion

Leveraging AI tools for financial management presents numerous advantages. From enhancing accuracy and efficiency to providing robust fraud prevention, AI tools are transforming the financial landscape. Businesses are encouraged to adopt these innovative solutions to remain competitive and enhance financial operations. By choosing the appropriate tools and integrating them effectively into existing systems, companies can unlock new levels of financial proficiency and strategic planning. AI tools for financial management are not just an option—they’re a necessity for modern businesses striving for excellence.

FAQ

Q1: What are the main benefits of using AI tools in financial management?

AI tools enhance accuracy and efficiency, provide real-time data analysis, reduce human errors, and lower operational costs, thereby optimizing various aspects of financial management.

Q2: How do AI-powered budgeting tools differ from traditional budgeting methods?

AI-powered budgeting tools automate the creation and adjustment of budgets using real-time data and predictive analytics, resulting in more accurate and flexible financial plans compared to static traditional methods.

Q3: What challenges might businesses face when integrating AI tools into their financial systems?

Common challenges include data compatibility, system integration issues, and the need for comprehensive staff training. These can be mitigated through thorough planning and professional support.

Q4: Which AI accounting software is best suited for small businesses?

Software Z is ideal for small businesses, offering cost-effective solutions with excellent support, making it a great choice for startups and smaller enterprises.

Q5: Why is fraud detection important in financial management, and how does AI assist?

Fraud detection is crucial for protecting businesses from financial losses. AI assists by continuously monitoring transactions and using advanced algorithms to flag and prevent fraudulent activities.